Living Peacefully in an Angry Period

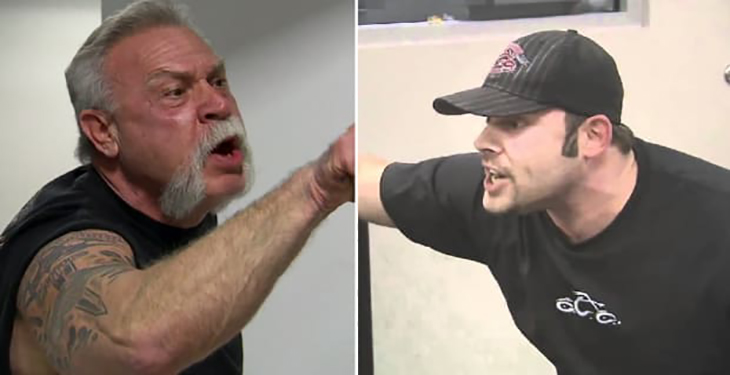

One of the idiosyncrasies that attracted viewers to the “American Chopper” television series was the prevailing tension that existed among the Teutle family members (Paul Sr., Paul Jr., and Michael). Eventually, this creative tension escalated to gratuitous outbursts of anger, driving emotionally weary viewers away.

Reality TV is seldom “reality.” It is contrived, scripted, and staged by producers seeking to pit people against one other. Staged angry outbursts […]