One of the major reasons people avoid planning for their financial future is the fear of making a mistake. There are so many questions, so many choices, and so many variables that it is easy to say, “Forget it. It would be easier to try giving the cat a bath than sort this out.” When a family does eventually decide they do need to plan ahead, the process of analyzing all of the options and risks can readily turn into another paralyzing roadblock.

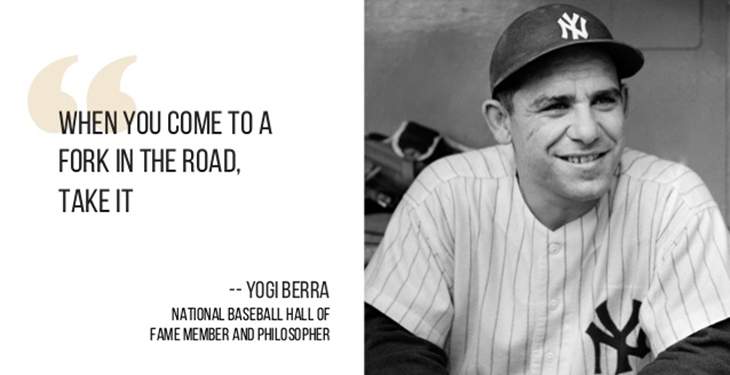

A great piece of advice about financial planning may just come from the world class philosopher, Yogi Berra. “When you come to a fork in the road, take it.” A fork in the road presents a choice on the route to your chosen destination. While driving, taking the wrong turn can either send you away from your destination, or possibly result in delaying your arrival. When it comes to financial planning, we need to understand that there is more than one path to success but allowing ourselves to become frozen in time will almost surely result in going nowhere and not reaching our goal. Let’s look at some roads to avoid and some that are legitimately either/or decisions.

One choice to be avoided is to head through life under insured. Life insurance is often an expensive proposition that seems burdensome and boring. However, the risk of leaving our spouse and children without support should never be seriously considered. The Christian Churches Pension Plan, nor any of its employees or associates, offers insurance advice. However, we do encourage everyone to find someone who can be trusted to help avoid this area of potential disaster.

Another fork we encourage people to avoid is trying to get rich quickly. The recent stories of day trading GameStop, AMC, and other stocks based upon advice from Reddit may seem thrilling, but the risks and dangers are high. A number of years ago, we were involved in a conversation with a father encouraging his son to create a long-term plan to build a stable financial base for himself and his family. The young son was not interested in any of the “stodgy, boring ways of old” to build his fortune. He was interested in shorting stocks on margin and day trading penny stocks and options. This fork in the road offers thrills and excitement, but it also offers extremely high risk. Some of the strategies used can actually lead to losing more money than invested.

For the vast majority, there are any number of forks in the road that can be taken that will ultimately lead to the destination of financial stability. Some people working in a nonprofit environment will prefer to use a 403(b) plan to save for their future while others opt for a defined benefit plan like the Christian Churches Pension Plan. Still others will opt for a mix of both. Some people prefer to invest through actively managed mutual funds while others prefer low-cost unmanaged index funds. One person may prefer to choose their own investment mix of funds while another may opt for a Target Date Plan that automatically changes the investment mix focused on a fixed date of retirement. In reality, any of these roads will work. At times along the path of life, one choice or another may appear to have been a better choice, but that too will change based upon market circumstances.

The bottom line for us today is there is no single perfect choice that anyone can make for their financial security. The vital point is that we all need to adopt a plan for saving over time and then execute that plan. The sooner we make and fulfill this commitment, the smoother our path will be. Everyone will find that the value of their nest egg experiences ups and downs. Embrace the down moments as opportunities to invest at lower prices.

Don’t allow the search for the perfect financial plan to paralyze you. Identify your financial destination. Set your planned route and get on the way. There is no time better than today to begin!